The Bank of Namibia says uranium mining growth is expected to slow in 2024 due to water supply issues. This was contained in the bank’s latest economic forecast.

Uranium mining in Namibia has contributed N$4.1 billion (2022) towards the national gross domestic product (GDP) and N$4.7 billion in 2023.

In 2020, Namibia produced 11% of the uranium worldwide and was ranked as the second largest producer, behind Kazakhstan.

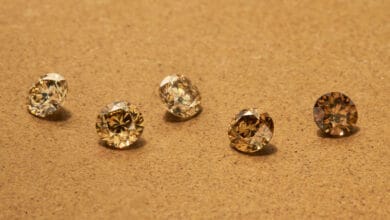

According to central bank governor Johannes !Gawaxab, diamond mining is expected to decline due to low production and international prices. Metal ores are also expected to decline due to resource depletion.

!Gawaxab said Namibia’s economic outlook is a reflection of what is happening globally.

“Global growth is projected to remain slow in 2024 at 3%, before improving slightly to 3.2% in 2025,” said !Gawaxab.

This sluggish global growth is attributed to factors like rising interest rates and limited government spending flexibility worldwide, he added.

The report predicts a similar trend for Namibia, with domestic economic growth expected to decelerate to 3.7% in 2024 before picking up steam and reaching 4.1% in 2025.

“This slowdown is mainly due to weaker global demand and slower growth in the mining industry, a mainstay of the Namibian economy,” said !Gawaxab.

Service industries like shops, restaurants, transport companies, banks and government offices are expected to grow steadily throughout 2024 and 2025.

“The bank expects the wholesale and retail trade sector to benefit from improved consumer spending and construction activity,” said !Gawaxab.

According to the report, manufacturing, especially for things like drinks and leather products, is expected to grow in 2024.

Construction is also expected to pick up in 2024 due to more activity in the mining sector and government projects.

The agriculture sector is expected to slow down in 2024 due to challenging weather conditions, with growth expected to pick up in 2025.

According to !Gawaxab, the risks to domestic economic growth come from water supply constraints, drought conditions and high costs of key import items.

“Domestic risks include water supply interruptions that could continue to affect mining production at the coast. Possible adverse weather shocks which could cause spikes in food prices, coupled with supply chain disruptions from global trade flows.”

The electricity and water sector is expected to decline in 2024 before bouncing back in 2025.

“The slowdown in 2024 is mainly on account of a high base in 2023, with the rainfall around Ruacana expected to reduce to normal levels in 2024,” said !Gawaxab.