Tertiary Minerals plc is pleased to announce details of the upcoming Phase 3 drill programme at Target A1, its silver-copper-zinc prospect within the Mushima North Project.

Mushima North is located in the prospective Iron-Oxide-Copper-Gold region of Zambia, and Target A1 is a polymetallic, silver-copper-zinc prospect located 28km to the east of the historic Kalengwa copper-silver mine which is currently under redevelopment.

Richard Belcher, Managing Director of Tertiary Minerals plc, commented:

“We are delighted that we will be drilling again at Target A1 this season. Drilling again before the rains, rather than waiting until the start of the next dry season in March-April next year, shows our resolve to aggressively advance this Project and add shareholder value.

“Target A1 now has a surface footprint of approximately 450m by 400m, with mineralisation intersected to a vertical depth of up to 84m. However, the mineralisation remains open to the north/northwest, south/southeast and at depth. This drill programme will test the potential continuation of mineralisation along strike and at depth, as well as providing additional infill drilling. This work is aimed at bringing us closer to our goal of producing a maiden mineral resource in the next 12 months.

“We eagerly await the start of the drilling programme and I look forward to providing updates in the coming weeks.

Drilling Programme

A programme of approximately 1,000m of Reverse Circulation (“RC”) drilling is planned as a series of east-west drill lines spaced approximately 100m apart (north-south). Holes will be collared approximately 50 to 100m apart along the east-west lines and drilled to a nominal depth of approximately 100m. Deeper holes (approximately 150m) will also be undertaken in key areas to further understand the potential continuation of mineralisation at depth. The drill programme at Target A1 is designed to test:

- further lateral extensions of the known mineralisation, particularly around the high-grade silver and copper mineralisation previously intersected in drillhole 25TMNAC-038.

- the continuity of mineralisation between wider-spaced drill lines, by obtaining additional mineralisation intersections.

- the depth extension of the known mineralisation up to 150m vertically.

The work will also give insights into the mineralisation style and grade continuity and provide data to support the production of a maiden Mineral Resource Estimate, if future drilling results warrant such an approach.

The drill programme is being conducted by Ox Drilling which also completed the Phase 1 and Phase 2 drill programmes. The drill programme is expected to commence in early November, will take approximately 2 weeks to complete and is planned to be finished prior to the on-set of the heavy rains in the area which will inhibit further on-the-ground exploration until March-April 2026. Samples will be initially analysed on site using a portable X-Ray Fluorescence (“pXRF”) analyser for copper and zinc. Selected mineralised intervals will then be submitted for external assaying at a certified laboratory for a suite of elements, including silver, copper, zinc, bismuth, antimony and gallium.

Target A1

Target A1 is a large copper-in-soil anomaly (3.1km by 1.7km) with copper values up to 302ppm per pXRF associated with a 1.7km by 0.5km zinc- and coincidental 1.3km by 0.3km silver-in-soil anomaly.

Phase 1 drilling (1,486m) in 2024 targeted the copper-in-soil anomaly and returned broad but generally low-grade copper mineralisation as reported in the news release dated 28 October 2024 (e.g. 57m at 0.20% Cu from 14m downhole, hole 24TMNAC-004). Higher grade copper mineralisation was also intersected within these broader zones (e.g. 6m at 0.58% Cu within 35m at 0.21% Cu, from 22m downhole, hole 24TMNAC-024). Drilling over the silver- and zinc-in-soil anomaly (drill line: 8506925N) to the east identified wide and thick, near surface silver mineralisation associated with low-grade copper and/or zinc mineralisation.

The Phase 2 drill programme (1,116m) targeted the silver and zinc-in soil anomaly. The silver mineralisation has now been confirmed to extend approximately 450m northwest-southeast and by 400m northeast-southwest, to a depth from near surface to 84m and remains open both to the north/northwest, south/southeast and at depth.

The mineralisation at Target A1 is associated with a massive, haematitic and carbonaceous silty-sandy conglomerate. Where visible, copper mineralisation is in the form of the secondary copper minerals malachite and chrysocolla. The mineralogical speciation of silver and zinc is yet to be determined. Elevated bismuth (up to 991 g/t), antimony (up to 0.21%) and gallium (up to 40 g/t) are also associated with the mineralisation in places.

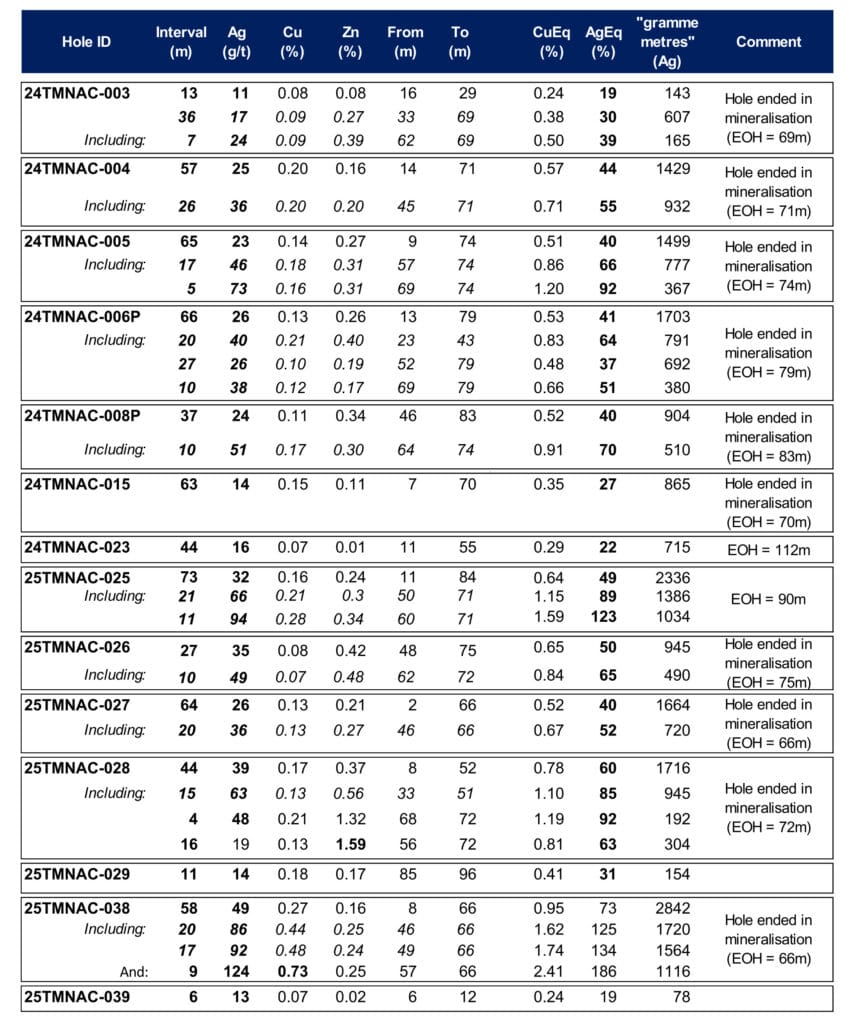

Drilling results (previously reported) from the Phase 1 and 2 drilling programmes are presented in Table 1 on the next page.

Table 1. Selected silver intersections from Phase 1 and 2 drilling at Target A1. Equivalent grades (“Eq”) are for illustrative purposes only.

Note to Table 1:

- Reported intersections (downhole, true widths unknown) are based on a cut-off grade of 10 g/t Ag. Intervals start and end with ≥10 g/t Ag and up to 3m consecutive internal dilution has been allowed. All grades are averages weighted by sample length.

- Silver values are rounded to whole numbers.

- EOH means End of Hole.

- CuEq (%) and AgEq (g/t) are the copper and silver equivalent grades, respectively, and were calculated assuming commodity prices of Cu: US$4.5 lb, Ag: US$40 oz, Zn: US$1.2 lb and 100% recovery. No information on beneficiation recoveries is available at this stage. The metal equivalent values are for illustrative purposes only.

- Gramme metres for silver are the silver values (g/t) multiplied by the intervals (m).

Mushima North Project

The Mushima North Copper Project (Licence 27068-HQ-LEL) is held through Group company Copernicus Minerals Limited (“Copernicus”), which is 90% owned by Tertiary Minerals (Zambia) Limited and 10% by local partner, Mwashia Resources Limited.

The Project lies 20km to the east of the Kalengwa copper mine in northwest Zambia, one of the highest-grade copper deposits ever to be mined in the country. In the 1970s, high-grade ore, average approximately 11% Cu copper, was trucked for direct smelting at other mines in the Copperbelt. The Kalengwa mine is currently under redevelopment and is expected to produce 15,000 tonnes of copper annually.

Numerous other geochemical and/or geophysical targets (A2, B1, B2, B3, C2) are yet to be drill tested. Many of these are located within 12km of Target A1.